Are you having problems with the IRS?

Are you being hounded with letters and notices from the IRS or Franchise Tax Board? Better yet, calls or letters from collection agencies claiming the IRS sent them your account to handle?

There are advertisements on the radio and television of national chains claiming you can settle your account for “cents-on-the-dollar.” In fact, they guarantee this. Don’t be fooled. As you know, life is not guaranteed – especially your tax life. It all depends on your facts and circumstances.

Christina Carter Tax Service is here to help you resolve your tax problems and put an end to the misery that the IRS can put you through – once and for all. Let’s stop the threatening letters! It is time to get your life back!

Our taxpayer representation services include:

- Personal taxes

- Non-filing

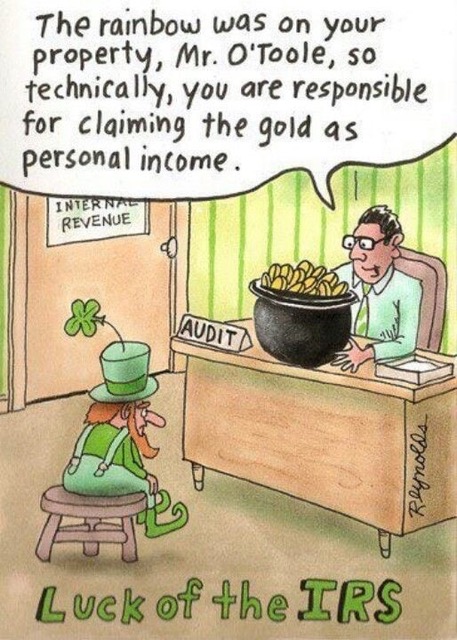

- Underreported Income

- Back Taxes

- Collections

- Liens

- Bank Levy

- Wage Garnishment

- Penalties Abatement

- Payment arrangements

- Offer-in-Compromise

- Non-Collectable

- Innocent Spouse

- Internal Revenue Service

- Franchise Tax Board

How We Can Help with IRS Tax Problems

Christina Carter Tax Service is here to help you resolve your tax problems and put an end to the misery that the IRS can put you through – once and for all. Let’s stop the threatening letters! It is time to get your life back!

Common IRS Tax Problems We Solve:

- Unfiled Tax Returns – If you’ve fallen behind on filing, we can help you catch up and avoid penalties.

- Back Taxes & Payment Plans – We work with the IRS to set up manageable payment plans and offer-in-compromise settlements when possible.

- Tax Liens & Wage Garnishments – If the IRS has placed a lien on your property or started garnishing your wages, we’ll help you negotiate a solution to remove or reduce these penalties.

- IRS Audits & Tax Notices – Being audited or receiving a Notice of Deficiency from the IRS? We will represent you before the IRS and ensure your rights are protected.

- Tax Levies & Bank Account Seizures – If the IRS is threatening to seize your assets, we’ll help prevent or stop enforcement actions.

No matter how complex your tax situation is, we have the experience and expertise to help you find a solution and get your finances back on track.

Steps to Resolving Your IRS Tax Issues

If you’re facing IRS tax problems in San Mateo, CA, here’s how we can help you find a resolution:

Step 1: Free Consultation

We start with a one-on-one consultation to evaluate your tax situation and determine the best course of action.

Step 2: Review & Analysis

Our team reviews your tax records, IRS notices, and financial documents to identify any discrepancies or areas where we can negotiate on your behalf.

Step 3: Develop a Resolution Strategy

Depending on your situation, we’ll explore various options, such as installment agreements, penalty abatement, offer-in-compromise settlements, or audit representation.

Step 4: Work with the IRS on Your Behalf

We handle all IRS communications to negotiate favorable terms and ensure compliance, so you don’t have to.

Step 5: Ongoing Support & Compliance

Once your tax issues are resolved, we provide long-term financial planning and tax management services to prevent future problems.

Get IRS Tax Help in San Mateo, CA – Contact Us Today!

Dealing with the IRS can be stressful, but you don’t have to face it alone. At Christina Carter Tax Service, we provide trusted IRS tax help in San Mateo, CA, giving you the guidance and support needed to resolve your tax issues. So whether you need help with back taxes, IRS audits, wage garnishments, or tax liens, our experienced team is here to help you find a solution and move forward with peace of mind.

Don’t live in worry and fear any longer: just contact us today to schedule a consultation and start resolving your IRS tax problems! Let us help you regain financial stability and take control of your taxes.

Disclaimer

The accounting services provided by this firm do not require a state license.